What is becoming one of my favorite newspapers, The Daily Herald, from the Orem-Provo area has published a "local opinion" by George Handley.

Believe it or not, George is apparently a BYU professor, native Utahn, Provo citizen, practicing Mormon and a life long Democrat. But that is OK, because I think after you read what George wrote you (like myself) will agree with the man.

And I hope you will carefully consider what Mr. Handley has to say.

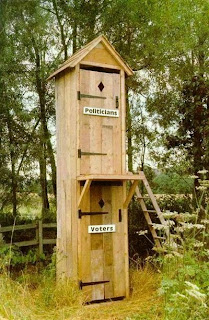

The Rinos (Republicans in name only) most of whom have shown us just how corrupt they actually are...and who refuse Ethics reforms, campaign finance reforms and significant property tax reform, are as stilted and dirty as the money they have extorted and embezzled from us and from "special interests".

And like motor oil after 6,000 miles, their lubrication of Real Estate and Developer skids has left us citizens with worn patience, friction between property taxpayers, and chafed citizens due to conflict of interest, dirty, and unfiltered (by logic and common sense) legislation.

This session will undoubtedly go down as one of the most shameful and disgusting legislative sessions in history. To attempt to salvage incompetence and disinterest in record numbers of citizens voices, by 5th week desperate sideshow theatrics, knowing full well it is political grandstanding, is beyond political forgiveness.

We asked for property tax reform - we got nothing.

We asked for property tax relief - we got nothing.

We asked for common sense taxation on three-acre minimum size lots - we got nothing.

We asked for ethics reform - we got nothing.

We asked for campaign finance reform - we got nothing.

We ask simply to live in freedom and liberty - instead we got HB 466 taking those constitutional rights away from some of us by developer friendly legislation.

We asked that it be repealed - we are getting a political sideshow and grand standing.

We asked for a Blue Ribbon Study commission to research property taxation best practices - we got a GOP lead and majority of incestuous legislators funding themselves to waste our tax money further and more importantly slow roll and significant property tax reform measures. The findings will have no credibility and they were told specifically they must have citizen participation and involvement - we got nothing but fraud, waste and abuse.

And there was more. Much more...one in four bills introduced, at minimum, were conflicts of interest. For example according to the Deseret News, "• Rep. Gage Froerer, R-Huntsville, a real estate broker, introduced four bills dealing with real estate law. " And he was involved in every one of the "we got nothings" detailed above.

If you are not convinced that Mr. Handley is correct about it being time to seriously consider voting for Democrats to replace Republican incumbents in Utah, you need to reconsider your grasp on reality. And you need to consider if the present one party legislature, left unchecked another session, will leave any Utah citizen with any rights.

"Democracy is based on the conviction that man has the moral and intellectual capacity, as well as the inalienable right, to govern himself with reason and justice." Harry S. Truman

We all need to ask ourselves if we think we have been "governed with reason and justice." If you think you have been...then "I got nothing for you but hope for the future and for change."

Namaste,

D-Bell

Monday, 25 February 2008

Local opinions: Political competition needed in Utah County

Daily Herald

George Handley

As a college student twenty years ago, I traveled behind what was once known as the Iron Curtain and saw firsthand how a single-party system creates a culture of public disengagement with politics. I learned that democracy without political plurality is not the rule of the people but the rule of hardened tradition and capricious power. Political competition keeps parties answerable to the people about what they are doing and why.

In Utah County (and I believe also in Weber County. machman), however, I believe we have seen a slow and steady erosion of democracy. We have seen many Republicans chosen for, not elected to, office and many who have never run against opposition.

Without a single statement from LDS church leadership to back it up, we have heard for years the empty claim, if not the unspoken assumption, that "good" Mormons can only be Republicans. This, a myth that makes reason stare not only in a plural society like America but in an increasingly international church, not to mention in a party as apparently inhospitable to Mormons as Mitt Romney's party is. Perhaps Romney's fate stings, but his spurning by the evangelicals comes as no less an assault than that experienced by Mormon Democrats in Utah culture for some time. Recently, I read one Republican incumbent in Utah County express "surprise" that a Democrat, and fellow Mormon, would choose to run against him. Surely such surprise is a symptom of a broken system.

Freedom depends on diversity. It is not secured through staid tradition, chauvinism, censorship, or intimidation. Consensus that relies on habitual and categorical trust of some and distrust of others is a threat to the free flow of information and to freedom itself. Freedom is secured in a culture that acknowledges diversity of opinion and celebrates genuine exchange of ideas. In a culture of exceptional homogeneity of belief, the preservation of political openness is even more vital. I suppose this is the same reason why the LDS church depends on councils, counselors, and auxiliaries. It impoverishes a church, as it does a plural society, for anyone to feel shamed merely because of a difference of opinion, as if holding a minority viewpoint were necessarily a symptom of following the wrong spirit.

In a single-party political culture like we have here in this county, our choices have become less meaningful because they are too few and too predictable. I believe this contributes to the growing public disengagement in local politics. Once our state officers are no longer answerable to us, there is nothing left for them to do but to try to distinguish themselves by being the most conservative crab in the barrel. Utah's political dramas have been reduced to a battle between moderate Republicans and the vocal extreme right wing, a group who have made it necessary for the otherwise politically reticent LDS church leadership to speak out in order to rein them in on such issues as immigration and gun control. As we saw in the voucher battle, the energy spent on these battles has drawn the Republican Party farther to the right and away from the middle where most Utahans find themselves.

Diehard straight party voters do a disservice to their own party and to democracy itself. I would like to challenge my Republican and unaffiliated friends to take a closer look at the Republican Party's political behavior in the state legislature. An honest look reveals a crying need for a more balanced two-party system. The Democrats who have announced their candidacy for state office in Utah County (an soon to be in Weber County, machman) thus far deserve close attention and, I submit, active support, not a partisan knee-jerk dismissal. They are socially conservative, morally upstanding, visionary, and well-seasoned by experience. Their political ideals are arguably more consistent with most polls regarding Utah voters' values on education, environmental stewardship, health care, and immigration than those currently in office. And even when they present new and challenging positions, maybe there is something we can learn by listening.

George Handley, a humanities professor at Brigham Young University, is a native Utahn and citizen of Provo, a practicing Mormon, and a lifelong Democrat.

Amen brother Handley!!

Machman